Radisson’s New Mineral Resource Estimate and Geological model deliver higher grades at O’Brien; 9.48 g/t Au for Indicated resources and 7.31 g/t Au for Inferred resources

Press release highlights:

New Mineral Resource Estimate

Using a 5.00 g/t Au cut-off grade, the current mineral resource estimate reports:

- Indicated Resources of 949,700 tonnes at 9.48 g/t Au, for a total of 289,400 oz Au

- Inferred Resources of 617,400 tonnes at 7.31 g/t Au, for a total of 145,000 oz Au

The New Mineral Resource Estimate is based on:

- The New litho-structural interpretation released in March 2019

- 16,201 m additional drilling from F, 36E and Vintage Zones.

Large increases in contained gold ounces and average gold grades

The new mineral resource estimate has resulted in a large increase of contained gold oz per vertical meter as grade and contained ounces have increased across all categories at all cut-offs. (See table 1 below)

New Litho-Structural Model unlocks the “jewellery” box mystery of the high-grade O’Brien mine

The new structural model has resulted in a much better comprehension of the O’Brien gold project, highlighting a strong compatibility with the historic data and geometry of the Old O’Brien mine, where only 3 veins returned 90% of the historic production at an average grade of 15.25 g/t Au.

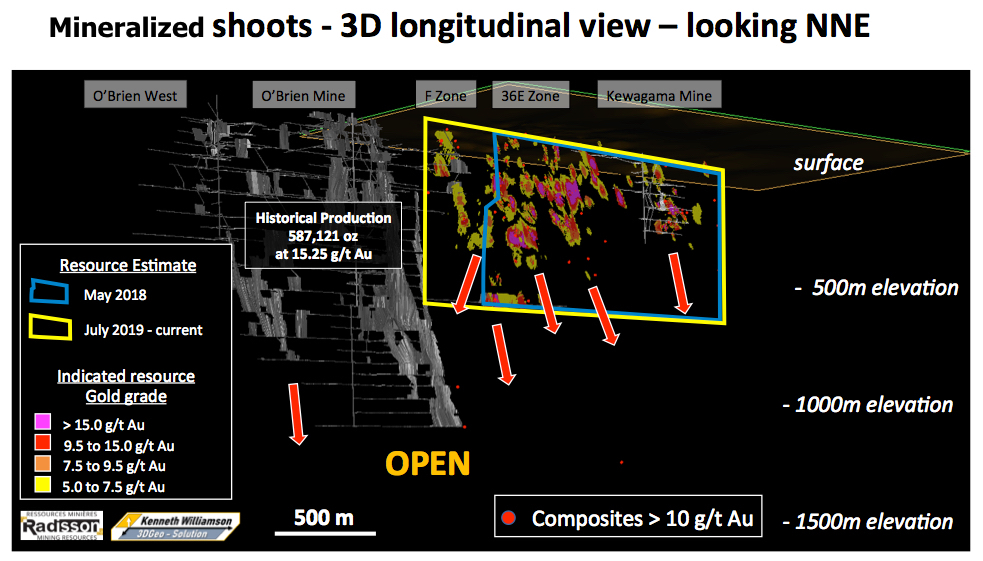

New Litho-Structural Model unlocks Significant property wide Exploration Potential along strike and at depth (See O’Brien gold project longitudinal section)

Current mineral resource area is only defined to 550 metres depth. Two historical drill intercepts have returned 17.46 g/t Au over 1.00 m and 13.68 g/t Au over 0.32m below 1,000 m depths. Other mines in the area have exceeded depths well below 1,000 m. Current mineral resource area is adjacent to the old O’Brien mine where historic production reached a vertical depth of 1,100 metres and remains untested below.

High-priority resource expansion and exploration drill targets have been defined:

- In vertical extension of the 36E and F Zones

- Infill targets and in vertical extension of the Kewagama zone

- On the Vintage Zone

- Near surface on O’Brien West

Radisson Mining Resources Inc. (TSX-V: RDS, OTC: RMRDF) (“Radisson” or the “Company”) is pleased to announce the release of the New Resource Estimate for its 100% owned O’Brien gold project (“O’Brien”) located along the Larder-Lake-Cadillac Break (“L-L-C”), halfway between Rouyn-Noranda and Val-d’Or, in Quebec, Canada (See figure 1 and figure 2). The Mineral Resource Estimate was prepared in accordance with National Instrument 43-101 (“NI 43-101”) by independent consultant 3DGeo-Solution and is dated July 15, 2019. The F Zone, 36E and Kewagama zones of the O’Brien project are located within a 1.5 km corridor directly south of the L-L-C. The Vintage zone is parallel to and between 30 to 85 meters (“m”) north of the L-L-C.

Table 1 provides Mineral Resource Estimate at a 5.00 g/t Au cut-off and Sensitivity at other cut-off scenarios

Table 1: 2019 O’Brien Project Mineral Resource Estimate at a 5.00 g/t Au base case cut-off and Sensitivity at other cut-off scenarios

| Indicated | Inferred | ||||||

|---|---|---|---|---|---|---|---|

| Zones | Cut-off (g/t Au) | Tonnes (t) | Grade (g/t Au) | Ounces (oz) | Tonnes (t) | Grade (g/t Au) | Ounces (oz) |

| All Zones | 7.00 | 544,600 | 12.16 | 212,800 | 243,600 | 9.69 | 75,900 |

| 6.00 | 712,100 | 10.82 | 247,700 | 374,700 | 8.54 | 102,900 | |

| 5.00 | 949,700 | 9.48 | 289,400 | 617,400 | 7.31 | 145,000 | |

| 4.00 | 1,350,300 | 7.99 | 346,700 | 975,000 | 6.27 | 196,600 | |

| 3.50 | 1,599,900 | 7.32 | 376,800 | 1,208,100 | 5.78 | 224,700 | |

| 3.00 | 1,906,200 | 6.67 | 408,700 | 1,500,200 | 5.29 | 255,000 | |

- The independent qualified person for the current 2019 MRE, as defined by NI 43-101, is Kenneth Williamson, M.Sc., P.Geo, of Kenneth Williamson 3DGeo-Solution. The effective date of the estimate is July 15th, 2019.

- The Mineral Resources are classified as Indicated and Inferred Mineral Resources and are based on the 2014 CIM Definition Standards.

- These Mineral Resources are not Mineral Reserves as they do not have demonstrated economic viability.

- Results are presented undiluted.

- Sensitivity was assessed using cut-off grades from 3.00 g/t Au to 7.00 g/t Au. Cut-off grade is function of prevailing market condition (gold price, exchange rates, mining costs, etc) and must therefore be re-evaluated accordingly.

- Base case cut-off grade of 5.00 g/t Au was established considering the narrow nature of the mineralized zones, a gold price of 1,350.00 US$/oz or 1,755.00 C$/oz using a 1.30 exchange rate, a recovery of 87.4%, a gold selling cost of 5.00 C$/oz, an overall mining cost of 67.50 C$/t, a processing cost of 65.00 C$/t and a G&A / Environmental cost of 32.50 C$/t.

- High grade capping of 60.00 g/t Au was applied to raw assay grades prior to compositing. Compositing length was established at 1.50 m. Interpolation was realized using an inverse distance cubed (ID3) methodology within a 3m x 3m x 3m cell-size block model.

- Density data (g/cm3) was set to 2.82 g/cm3 based on available density measurements.

- A minimum true thickness of 1.5 m was applied for the construction of the mineralized zones model, which consist of 63 different mineralized zones.

- Following recommendation of Form 43-101F1, the number of metric tons and ounces was rounded to the nearest hundredth. Any discrepancies in the totals are due to rounding effects.

- Kenneth Williamson 3DGeo-Solution is not aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issues that could materially impact the current Mineral Resource Estimate.

Kenneth Williamson 3DGeo-Solution considers the 2019 MRE to be reliable and based on quality data, reasonable hypotheses and parameters that follow CIM Definition Standards and that the results, presented undiluted, are considered to have reasonable prospects for eventual economic extraction.

“We are very pleased with this substantial increase in grades across all resource categories at the O’Brien gold project. At a 5 g/t Au cut-off, the Indicated resource has increased by 74% to 289,400 oz at 9.48 g/t Au. The New litho-structural model not only defines a very robust resource, it opens up the project as a whole for its resource expansion and exploration potential at depth and along strike. These results come from the combined work of a high-calibre geological team and consultants.” commented Mario Bouchard, President and CEO.

“O’Brien is now positioned as one of the few undeveloped high-grade gold projects in Canada. The company remains focused on delivering growth to its shareholders by expanding the deposit and unlocking the exploration potential at O’Brien in a sustainable manner with respect to all stakeholders”.

2019 Resource Estimate Compared to 2018 Resource Estimate at a 5.00 g/t Au cut-off

| Indicated | Inferred | |||||

|---|---|---|---|---|---|---|

| Tonnes (t) | Grade (g/t Au) | Ounces (oz) | Tonnes (t) | Grade (g/t Au) | Ounces (oz) |

|

| July 2019 | 949,700 | 9.48 | 289,400 | 617,400 | 7.31 | 145,000 |

| March 2018 | 624,734 | 8.30 | 166,671 | 416,123 | 7.21 | 95,508 |

| Variance | +52% | +14% | +74% | +48% | +1% | +52% |

O’Brien gold project New Litho-Structural Model and Mineral Resource Estimate

The new structural interpretation is based on current and historic drill holes and highlights a strong compatibility with the historic data and geometry of the Old O’Brien mine, where 90% of gold production came from 3 veins at the crossing of a conjugated system (Sauvé et Trudel, 1989). Three preferential mineralized orientations are observed; EAST-NORTH-EAST (“ENE”), EAST-SOUTH-EAST (“ESE”) and EAST-WEST (“EW”). The Regional Lac Imau Fault, a deep-seated fault corridor, splays off the Cadillac Break at the O’Brien Property. This fault is trending EAST-SOUTH-EAST and is one of the main ore controlling structures.

Steep eastward plunging gold enrichment vectors (“ore shoots”) are identified on F, 36E, Kewagama and Vintage zones. These vectors occur at the intersection of the conjugated ENE and ESE quartz veins and locally, along the axes of asymmetrically folded quartz veins. In the current resource area, the vertical extension of the known ore shoots was defined by drilling to a depth of 550 metres. In comparison, the Old O’Brien mine production reached a depth of 1,100 metres and remains untested below.

A summary of Ore zones network interpretation and the revised litho-structural model is available on the company’s website and can be viewed by clicking the link below:

See new 3D litho-structural model presentation

The current mineral resource estimate has been elaborated using the litho-structural interpretation described above as a basis. As a result, a series of mineralized zones, interpreted to be intimately associated with the structures and ore shoots interpreted in the new litho-structural model, were constructed.

This structurally and geometrically constrained ore zone model is resulting in a model where high-grade continuity is enhanced within the ore zones.

A comprehensive description of key assumptions and parameters used are set out in a technical report that will be available on SEDAR and Radisson’s website within 45 days of this press release.

Radisson will look to increase property wide resources by targeting the vertical extension below the 36E, F and Kewagama zones, and by further testing the Vintage Zone and a near surface area at O’Brien West. Part of Radisson’s strategy also includes infill drilling within volumes of high grade inferred resource material where a potential for resource type conversion exists.

Qualified Person

Richard Nieminen, P. Geo, Exploration manager, acts as a Qualified Person as defined in National Instrument 43-101 and has reviewed and approved the technical information in this press release.

The Independent and Qualified Person for the Mineral Resources Estimate, as defined by NI 43-101, is Kenneth Williamson, M.Sc., P.Geo, of Kenneth Williamson 3D Geo-solution, and confirms that he has reviewed this press release and that the scientific and technical information is consistent.

About Radisson Mining Resources Inc.

Radisson is a gold exploration company focused on its 100% owned O’Brien project, located in the Bousquet-Cadillac mining camp along the world-renowned Larder-Lake-Cadillac Break in Abitibi, Quebec. The Bousquet-Cadillac mining camp has produced over 21,000,000 ounces of gold over the last 100 years. The project hosts the former O’Brien Mine, considered to have been the Abitibi Greenstone Belt’s highest-grade gold producer during its production (1,197,147 metric tons at 15.25 g/t Au for 587,121 ounces of gold from 1926 to 1957; Kenneth Williamson 3DGeo-Solution, July 2019). For more information on Radisson, visit our website at www.radissonmining.com or contact:

Mario Bouchard

President and CEO

819-277-6578

mbouchard@radissonmining.com

Certain informations contained in the press release are subject to receipt of all regulatory approvals. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements: This press release may contain certain forward-looking information. All statements included herein, including the scheduled Closing date, but other than statements of historical fact, is forward-looking information and such information involves various risks and uncertainties. There can be no assurance that such information will prove to be accurate, and actual results and future events could differ materially from those anticipated in such information. A description of assumptions used to develop such forward-looking information and a description of risk factors that may cause actual results to differ materially from forward looking information can be found in Radisson’s disclosure documents on the SEDAR website at www.sedar.com.